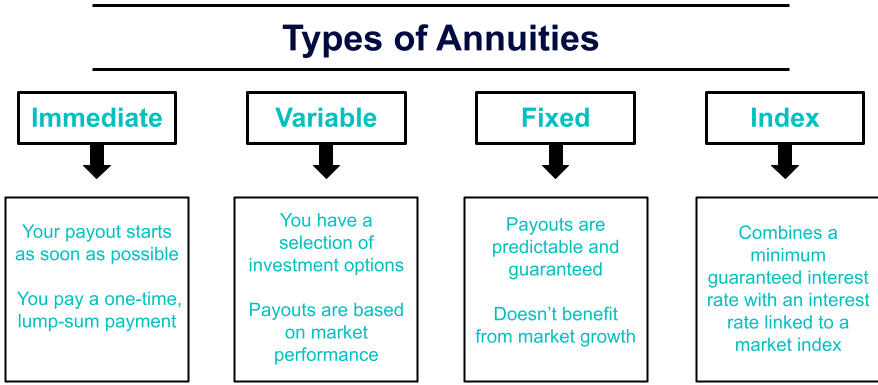

Annuities are a unique financial product that guarantees the buyer a steady income stream in the future in exchange for premium payments now. There are different types of annuities, each with different benefits and payment structures.

Speak with a licensed insurance agent today!

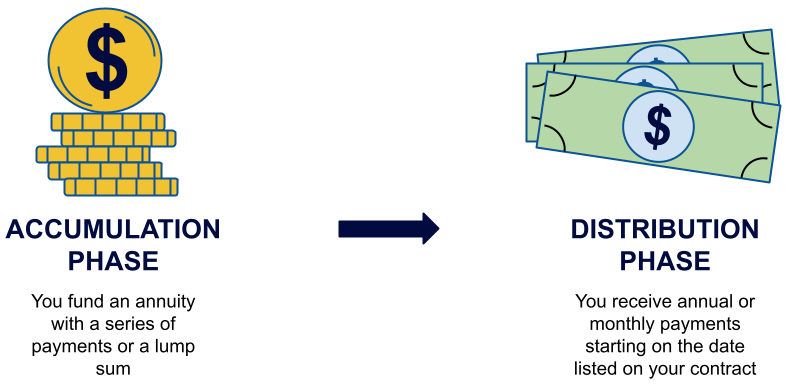

Annuities refer to a contract issued and distributed with the intention of paying out invested funds in a fixed income stream. You can fund an annuity using monthly premiums or lump-sum payments. Once the annuity is paid for, a stream of fixed payments can be accessed in the future. This stream of payments may continue for a set period of time or for the remainder of the annuitant’s life.

Annuities allow you to guarantee yourself an income stream later in life. They are great for addressing the risk of outliving your savings in retirement. If this happens, you may be forced to lower your standard of living significantly in your later years.

During the accumulation phase, the annuitant pays into their annuity plan. Afterward, the annuitization phase begins. When in this phase, the annuity commences payments to the annuitant.

There are many different types of annuities to choose from, so it helps to learn more about them before choosing. An insurance professional from JEMS of Insurance Group can help you find an annuity today. To get started with a free consultation, call 1-833-817-6252.

© 2023 Jems of Insurance Group, Inc. All Rights Reserved.

We are not connected with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all your options.