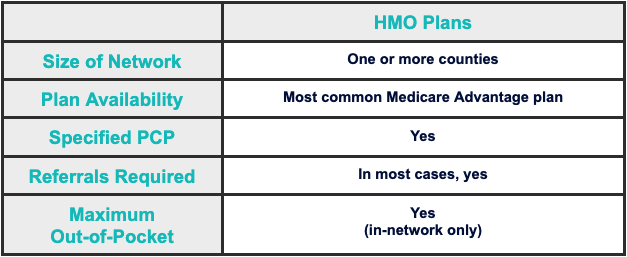

HMO stands for Health Maintenance Organization and is a type of Medicare Advantage plan. With an HMO plan, you are required to use the medical care providers within your network. If you seek medical care outside your network, you will likely have to pay the full cost of any services. There are exceptions to the network rule, which include emergency care, out-of-network urgent care, and out-of-network emergency dialysis. In some cases, you may be able to see a medical care provider outside your network for certain services. This is what’s known as an HMO with a POS (point of service) plan.

Speak with a licensed insurance agent today!

You will need to choose a primary medical provider, and in most cases, you will need a referral to see a specialist with an HMO plan. You may also note that your plan has certain rules. For example, you may have to get approval for services before receiving coverage. It’s very important to follow these rules to uphold the insurance contract. Like PPO plans, your HMO plan will most likely offer you prescription drug coverage.

Generally speaking, HMO plans offer less flexibility than PPO plans, but there are still many benefits to a Medicare Advantage HMO plan. To get the most out of your coverage, be sure to consult with your agent. They can make sure you get a policy that works for you. Your agent can help you understand the complexities of a Medicare Advantage plan so you can enjoy peace of mind knowing you are properly covered.

© 2023 Jems of Insurance Group, Inc. All Rights Reserved.

We are not connected with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all your options.