Medicare Supplement Insurance (also called Medigap) is for those enrolled in Original Medicare who want help covering the remaining costs of their care. This is not part of Original Medicare but instead purchased in addition to it.

Speak with a licensed insurance agent today!

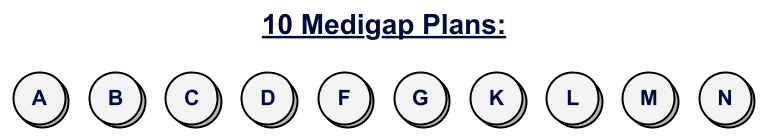

A supplement policy allows you to customize your insurance plan to your exact needs while covering more out-of-pocket expenses. Many people find that even with Original Medicare, the copays, coinsurance, and deductibles can be very high. A supplemental plan like Medigap can help protect you against unexpected medical bills. After your Medicare insurance pays their portion, your Medicare Supplement policy will pay their part, often the remaining costs.

Another welcome advantage to Medicare Supplement insurance is that there is no required network, unlike most Medicare Advantage plans. This means that you have the freedom to see any physician that accepts Medicare even if you are traveling far from home.

Keep in mind that Medicare Advantage and Medicare Supplements are two different types of insurance, and you cannot enroll in both. While an Advantage Plan is bundled and makes one plan out of many parts, it is still not necessarily complete coverage. One way to maximize coverage, customize your plan, and be seen by any doctor regardless of the network is with Medicare Supplement Insurance.

There is no better resource than your agent when it comes to understanding Medicare Supplement insurance. At JEMS of Insurance Group, we are always looking for agents with knowledge and dedication to join our incredible team. If you are a licensed agent looking to expand your horizons and connect people to the care they need, we have outstanding opportunities for you. When you are ready for the next step, contact JEMS of Insurance Group.

© 2023 Jems of Insurance Group, Inc. All Rights Reserved.

We are not connected with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all your options.